The Retirement Disaster You Won’t See Coming

You could lose 40% of your retirement savings overnight—and never see it coming.

Think that sounds extreme? It happened in 2008. Millions of Americans watched helplessly as their 401(k)s shrunk

by nearly half, just as they were preparing to retire. Some had to delay retirement for years, while others were

forced to drastically downsize their lifestyle.

The worst part? They didn’t know how to prevent it.

Now, you’re sitting on your own hard-earned savings, hoping history doesn’t repeat itself. But hope isn’t a retirement

strategy. Protection is.

Jan Levine, a veteran financial expert, helps pre-retirees secure their savings before disaster strikes. His secret?

A little-known financial loophole that lets you move your money to safety—without quitting your job, paying

penalties, or triggering taxes.

If you’re 55 or older and don’t have a guaranteed plan to protect your 401(k) from the next crash, keep reading.

This could be the most important retirement decision you ever make.

The Retirement Trap Most People Fall Into

Most pre-retirees follow a simple formula:

1. Work hard for decades

2. Contribute to their 401(k), sometimes with employer matching

3. Watch it grow (and try not to panic when the market drops)

4. Hope it’s enough when they finally retire

But hope is not a strategy.

If all your savings are tied up in the stock market and the economy shifts, you lose

control over your own future.

Most people don’t even realize there’s an alternative until it’s too late.

Jan Levine sees it all the time. He works with people who have spent 30, 40, even 50 years building their

retirement savings—only to realize they have no actual plan for keeping that money safe.

If you’re watching your account balance fluctuate and wondering:

● Is my money actually safe, or am I just hoping it won’t disappear?

● What happens if the market crashes right before I need to start withdrawing?

● Do I really want to gamble my retirement on forces I can’t control?

This uncertainty keeps people stressed, second-guessing, and stuck. The good news? You don’t have to feel this

way.

How an In-Service Rollover Protects Your Retirement

Most people assume that once their money is in a 401(k), it has to stay there until they retire or leave their job.

That’s not true. Thanks to a little-known rule called an in-service rollover, you can move your savings into a

safer, more stable financial vehicle—without quitting your job, triggering taxes, or facing penalties.

Here’s why this is a game-changer for retirement planning:

● You don’t have to leave your employer to take action. Most people think they’re locked into their 401(k)

plan until retirement or a job change. That’s not the case.

● You can protect your savings before disaster strikes. Instead of waiting for a market drop, you can move

your money into a secure, tax-efficient strategy now—one that guarantees your balance will never

decrease.

● You create guaranteed income for life. Unlike the ups and downs of the market, an indexed annuity locks

in gains and provides you with a steady stream of income for the rest of your life.

● You eliminate uncertainty. No more guessing. No more hoping the market won’t take another hit. Just a

clear, predictable plan for the future.

Why Retirement Planning Is More Than Just Your 401(k)

Retirement security goes beyond just having a big 401(k) balance. Real financial stability requires a holistic

approach, including:

● Medicare planning. Choosing the wrong coverage could cost you thousands.

● Long-term care protection. Most people avoid thinking about this, but it’s one of the biggest financial risks

in retirement.

● Asset protection. Making sure your money is working for you—not against you.

Jan doesn’t just focus on numbers—he looks at your entire financial picture to ensure you’re truly

prepared. His approach is personal, straightforward, and focused on protecting what you’ve built.

Your Retirement Future Is in Your Hands—What Will You Do?

You have a choice right now: Take control of your financial future or leave it to chance.

If you’ve read this far, something inside you knows the truth—you can’t afford to sit back and hope your retirement

funds will be there when you need them. You’ve worked too hard, sacrificed too much, and spent too many years

building your savings to let one market downturn decide your future.

The next crash won’t send you an invitation. It won’t wait until you’re "ready." And when it comes, you’ll either be the

person watching your savings disappear—or the one who planned ahead and secured guaranteed income for

life.

Jan has already helped countless people protect their retirement before it’s too late.

Will you be next?

Here’s what to do right now:

Email Jan at jan.levine@bankerslife.com

Connect on LinkedIn: linkedin.com/in/janmlevine

Take action before the market does.

You can keep gambling your retirement on forces you can’t control—or you can lock in your financial security

starting today. No second chances. No do-overs. Just one decision that changes everything.

Your future self is waiting. What will you tell them you did today?

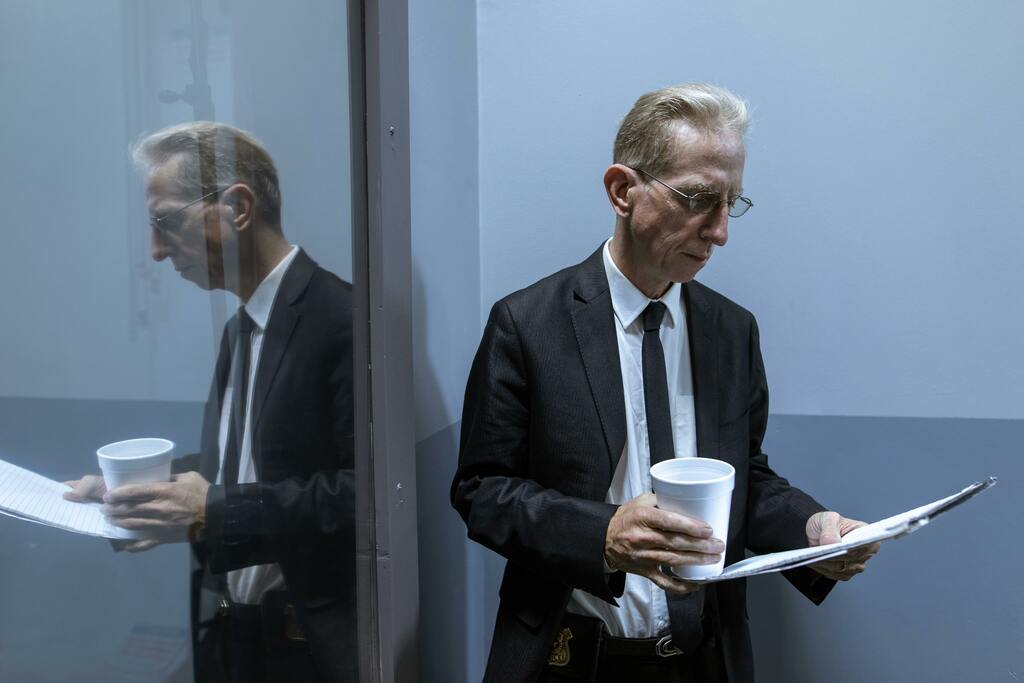

About Jan Levine

Jan Levine is a financial professional specializing in retirement planning, asset protection, and guaranteed

income strategies. Many pre-retirees unknowingly leave their 401(k)s exposed to market crashes, risking

decades of hard-earned savings.

With a career spanning from the 1980s, Jan has helped countless individuals

secure their retirement using little-known strategies like the in-service rollover.

As a top-performing agent at Bankers Life, he provides a holistic approach—covering Medicare, long-term care, and tax-efficient wealth

preservation.

If you want certainty instead of guesswork in your retirement plan, contact Jan at:

jan.levine@bankerslife.com

LinkedIn: linkedin.com/in/janmlevine.